Payroll calculation with example

ESI Eligibility Amount is specified in the Stat file. Select the pay cycle that specifies the payroll calculation frequency and pay date for the position.

Payroll Formula Step By Step Calculation With Examples

If the worker has worked 38 hrs.

. If the time unit for the payroll area is different to the time unit for the pay scale type and area. If a worker has eight hours of sick time the difference of 32 hours can be calculated automatically. Check 1 Biweekly Pay period 720 - 802 - Insurance.

If this field is left blank the system considers the Calendar Period as the basis for calculation. For example if you need to pay double time for an employee who worked 16 hours in a day you can overwrite the existing calculation with this formula. Example - August 2013 3 Bi-Weekly pay periods.

New joiners during payroll period. The 8 roughly equals four weeks of annual leave. For example if you promise an employee a take-home pay of 40000 per year you can gross up to make sure they actually receive that net amount.

Four hours to be paid at a rate of time and a half while the other four hours are considered double-time. The calculation would be 38 hrs. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts.

How to gross up payroll. Even when pay is grossed up for taxes it still might not cover all the taxes. Executing payroll refers to the disbursal of salaries to the employees and the payment of statutory dues like PF PT ESI and TDS.

Company PF Account. 28429 x 02965 8429 total tax withheld 28429 8429 200 net bonus As you can see in the example above you would need to pay your employee a gross payment of 28429 so they will receive a net payment of 200 after taxes. If you are on the payroll of the company then you will be treated as an employee of the company and.

Deductions are calculated accordingly and the pay is disbursed on time. Payroll agencies and most HRMS simply compute salary dues along with statutory liabilities. Their accrual withholding is made if necessary and additional information is usually required.

This value represents 40 hours per week. Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. Payroll Services is responsible for processing all payroll for biweekly and monthly-paid employees including the management of all withholdings and deductions as required by federal state and local government.

Gratuity calculation formula. The calculation for Holiday Pay is at a flat rate of 8 of the Gross Earnings. 1 week 12 per hour 146.

686 form to reflect the redesign. This document illustrates the manual calculation behind this function. We Provide a Doc Sample Layouts for a Ledger Invoice Checklist Statement Receipt Summary Spreadsheet and Other Documents.

For example if the employee has a total service of 20 years 10 months and 25 days 21 years will be factored into the calculation Tax Exemption Gratuity received under the Gratuity Act is exempt from taxation to the extent that it does not exceed 15 days of salary for every completed year of service calculated on the last drawn salary. A week and the payment schedule is for weekly payments with a rate of 12 an hour. In the example below the service of the employee is 6 years.

Reads part period parameters. Check your calculation. Payroll execution is what sets RazorpayX Payroll apart from other solutions.

Perk manages the Income Tax calculation once employees fill the tax declaration form on the app. According to the Holidays Act 2003. Lets try another example.

For example you might enter 2080 for a regular salaried worker. We would like to show you a description here but the site wont allow us. As we previously mentioned in addition to the specific payroll taxes related to FUTA SUTA and FICA income taxes are also calculated and withheld from payroll for most employees any 1099 contractor will need to report and pay self-employment tax if their net income is 600 or more.

The State Controllers Office has updated the Employee Action Request STD. The accrued payroll is an expense that will be paid out in the future but right now in the present you are still waiting for that to happen. Their calculation is performed regularly on a weekly or monthly basis.

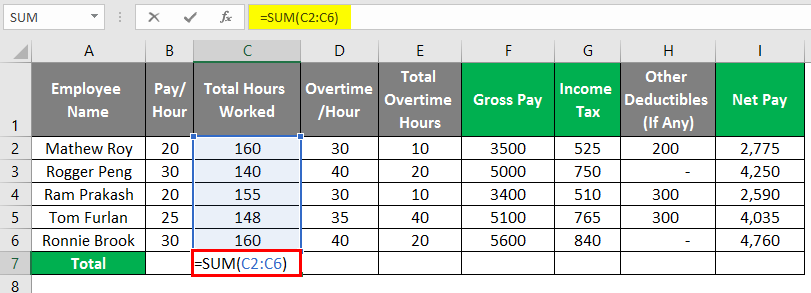

The Paycheck Calculator below allows employees to see how these changes affect pay and withholding. To calculate the payroll based on hourly requirements the organization also needs the rate assigned to the various classes of employees or workers. Years of service x Last drawn salary 15 26.

California government employees who withhold federal income tax from wages will see these changes reflected in 2021 payroll. Learn how to enable payroll and statutory features of payroll in TallyPrime to use the provident fund ESI NPS and others for Indian Payroll. This document is useful for functional consultants while analysing issues with Leave Provision calculations.

A payroll template is an automated software that takes care of the payroll calculation. Leavers on the first day of the next payroll period. Payroll is a critical operation for every organization to pay employee accurately their salary and enrollments on time1The idea of taking control of employees pay calculations are quite tedious if done manually and require more effort and time mainly for big organizations.

Try converting your. The holiday pay is accrued during the year and only applied to a final pay if the. Tax gross-up example 2.

Handle Processor Records and Salary Wages More Effectively with a Free Download Example in PDF Google Docs and Word Format. Reads part period parameters. The calculation of leave provision is performed in payroll via function QLPVR.

Where the last drawn salary includes basic salary and dearness allowance. Reads part period parameters. Note that the formula is broken into two parts.

But you can also gross up your regular payroll. If Deepika has served for 15 years in a company and her last drawn salary. Perk Payroll also relieves Finance teams by generating challans - PF ECR text file for PF and ESI Form MC for ESI PT Form V for professional tax and Form 24Q for TDS calculation.

MYOB Payroll calculates the annual leave rate in accordance with the Holidays Act 2003. However they do not execute payroll. System is advantageous as it provides a user friendly environment.

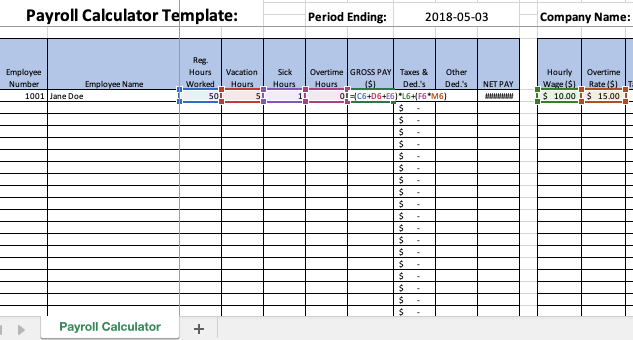

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

How To Do Payroll In Excel In 7 Steps Free Template

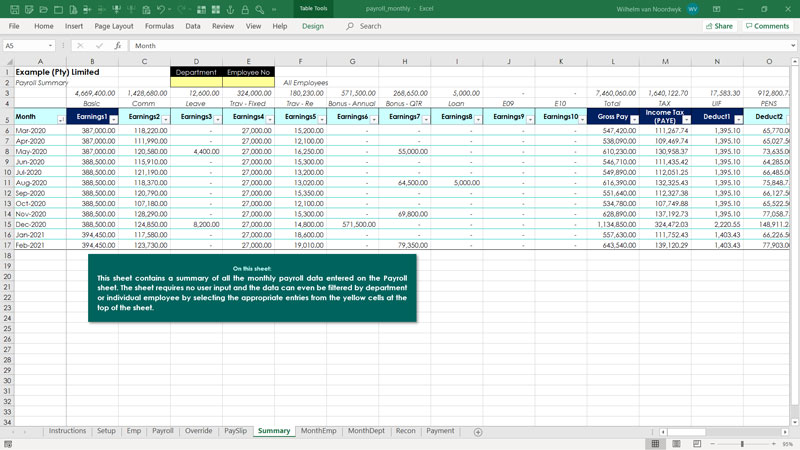

Excel Payroll Software Template Excel Skills

How To Do Payroll In Excel In 7 Steps Free Template

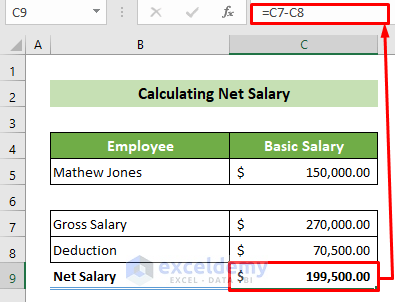

Payroll Formula Step By Step Calculation With Examples

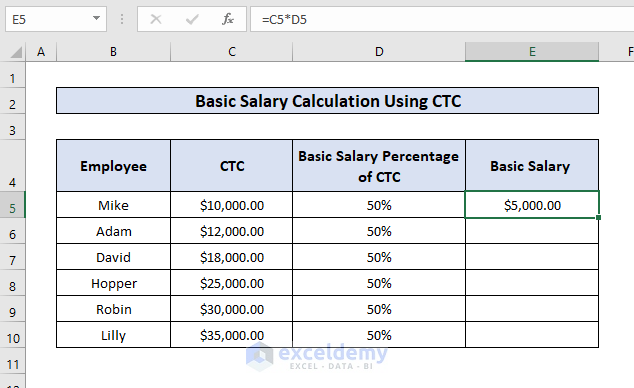

How To Calculate Basic Salary In Excel 3 Common Cases Exceldemy

How To Calculate Payroll Taxes Methods Examples More

Payroll Formula Step By Step Calculation With Examples

Salary Formula Calculate Salary Calculator Excel Template

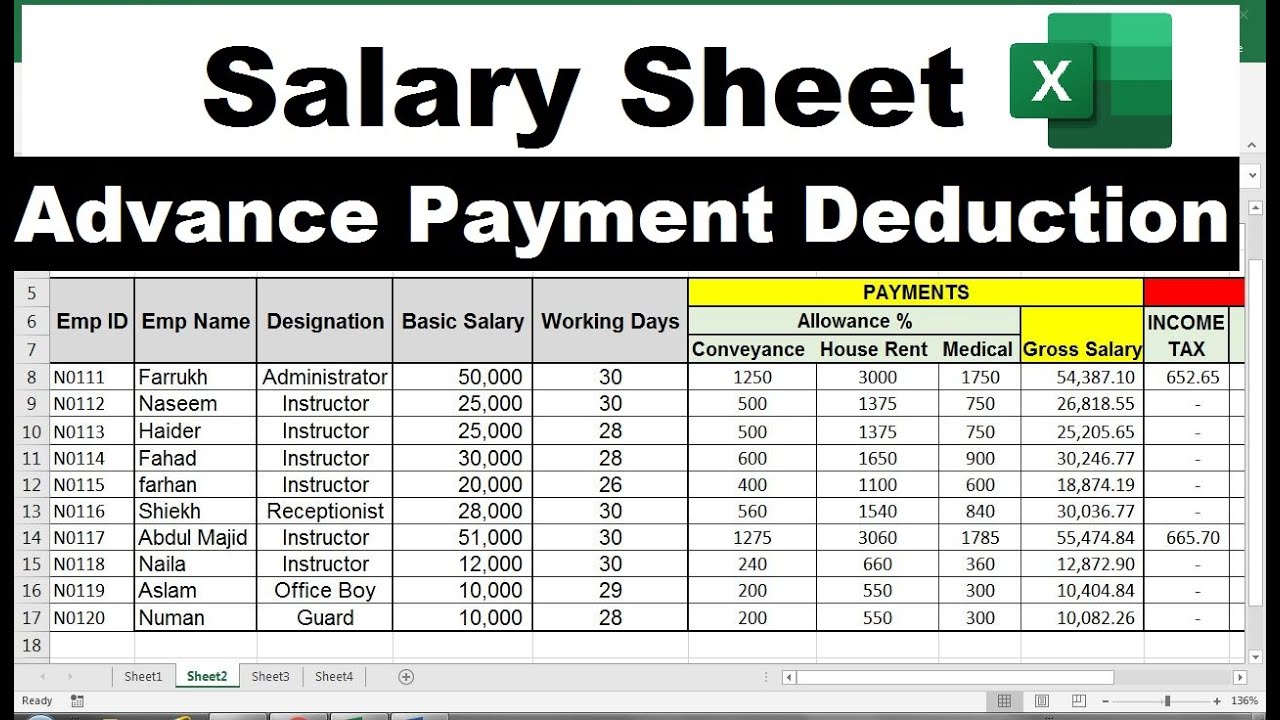

How To Make Salary Sheet In Excel With Formula With Detailed Steps

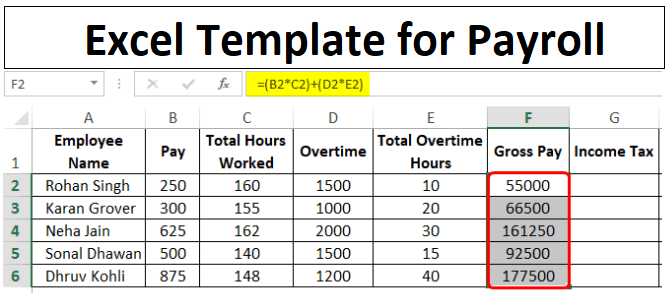

Excel Template For Payroll How To Create Payroll Template In Excel

Salary Sheet In Excel With Formula Salary Sheet Sample Youtube

Payroll Formula Step By Step Calculation With Examples

Excel Payroll Formulas Includes Free Excel Payroll Template

Payroll In Excel How To Create Payroll In Excel With Steps

Salary Formula Calculate Salary Calculator Excel Template