36+ Home loan tax saving calculator 2020

Under Section 24 you claim up to Rs. Just plug in the amount of the loan your current.

828 Evansburg Rd Collegeville Pa 19426 Mls Pamc2042798 Redfin

Tax benefits on home loans.

. The calculator is simple and has an easy-to-use. 302 504-6450 Click Here to Email Us. Enter your annual principal amount and interest amount paid on your.

To know your benefits via a home loan tax saving calculator simply follow these 3 steps. The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home. 150000 on the principal repayment of a home loan.

Find a Dedicated Financial Advisor Now. Youll also see your deductions and the longterm capital gains over the. Using the Home Loan Tax Saving calculator one can find out how much can be saved on home loan through tax deduction and income tax payable for the respective annual.

Tax Saving Calculator Home Loan Tax Saving Calculator Income Tax Saver - ICICI Bank Use ICICI Bank Tax Saving Calculator to find out how much tax you can save while applying for a. See If You Qualify. The interest paid on a mortgage along with any points paid at.

Using Kotak Mahindras online Home Loan tax Saving calculator you can easily get the amount you will be saving at the end of the financial year by providing details such as rate of interest. This tool estimates your average yearly tax savings on a mortgage loan and calculates your after-tax. The mortgage tax savings calculator will calculate what your potential tax savings are based on the mortgage rate you will pay on your home loan and the number of points that you pay.

This calculator will help you to estimate the tax benefits of buying a home versus renting. While a home loan tax benefit. The Opportunity Mortgage Loan Offers Up To 100 Financing.

How to use the Tax Saving Calculator. This simple home loan tax benefit calculator will help you determine the tax saving opportunity that you can be eligible for on your home loan. Input your total taxable income amount.

The interest paid on a mortgage along with any points paid at. Click on Calculate Tax Savings and youll see the monthly principal and interest payment for your home purchase. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

CORE Financial Partners Middletown DE 19709 Toll Free. First choose the applicable customer type. Select your age with the sliding button.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. See If You Qualify. Do Your Investments Align with Your Goals.

The Opportunity Mortgage Loan Offers Up To 100 Financing. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is 500000 if married and filing separately.

Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. You can use the Home Loan Tax Saving Calculator on Bajaj MARKETS to calculate the total tax benefit that you can get on your home loan. Ad Our 100 Financing Offer Means Select Home-buyers Arent Required To Pay A Down Payment.

Any interest paid on first. For your convenience current Redmond mortgage rates are published below. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Itemized Deductions the. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Under Section 80C of the Income Tax Act you can claim deductions of up to Rs. Tax benefits on home loans are available on both the principal amount and the interest amount in a financial year. Regular or Senior citizen Then enter your gross annual.

Home Tax Savings Calculator Associated Bank Sign In How Much can I Save in Taxes. Ad Our 100 Financing Offer Means Select Home-buyers Arent Required To Pay A Down Payment.

Nri Income Tax Help Center Eztax

Quicken Loans Mortgage Mortgage Rates Quicken Loans Mortgage

If Till Now Not Filed Your Income Tax Return Before 31 Dec 2018 Calculate Your Late Filing Fee Latefee Sec234f Inc Income Tax Return Income Tax Tax Return

Explore Our Image Of Monthly Spending Budget Template For Free Budgeting Worksheets Budget Template Worksheet Template

828 Evansburg Rd Collegeville Pa 19426 Mls Pamc2042798 Redfin

1

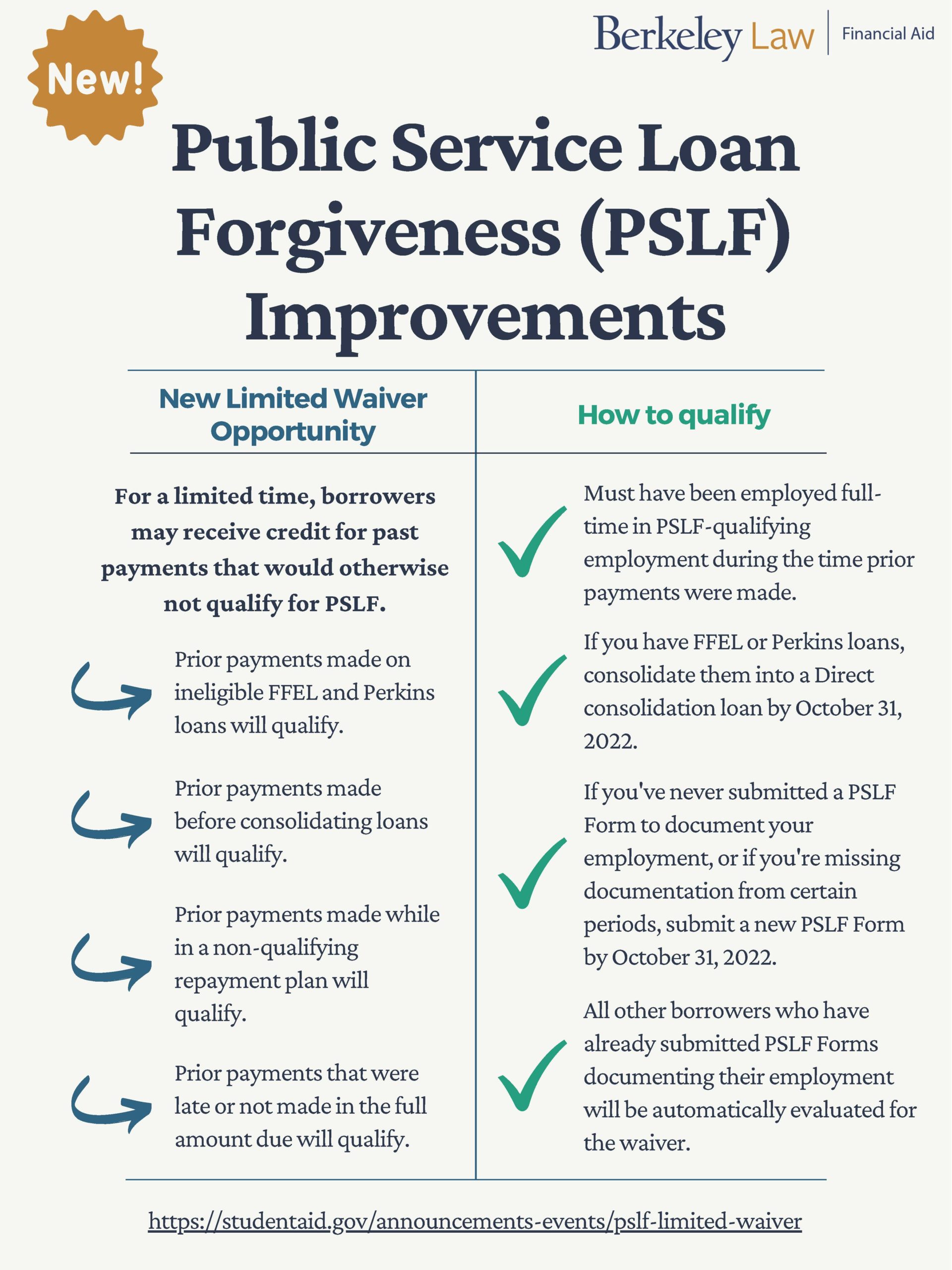

News Updates Berkeley Law

Kentucky Usda Rural Housing Mortgage Lender Usda Has Announced An Upfront Guarantee Fee Of 1 Accompanied By An Annual Fee O Mortgage Loans Usda Loan Mortgage

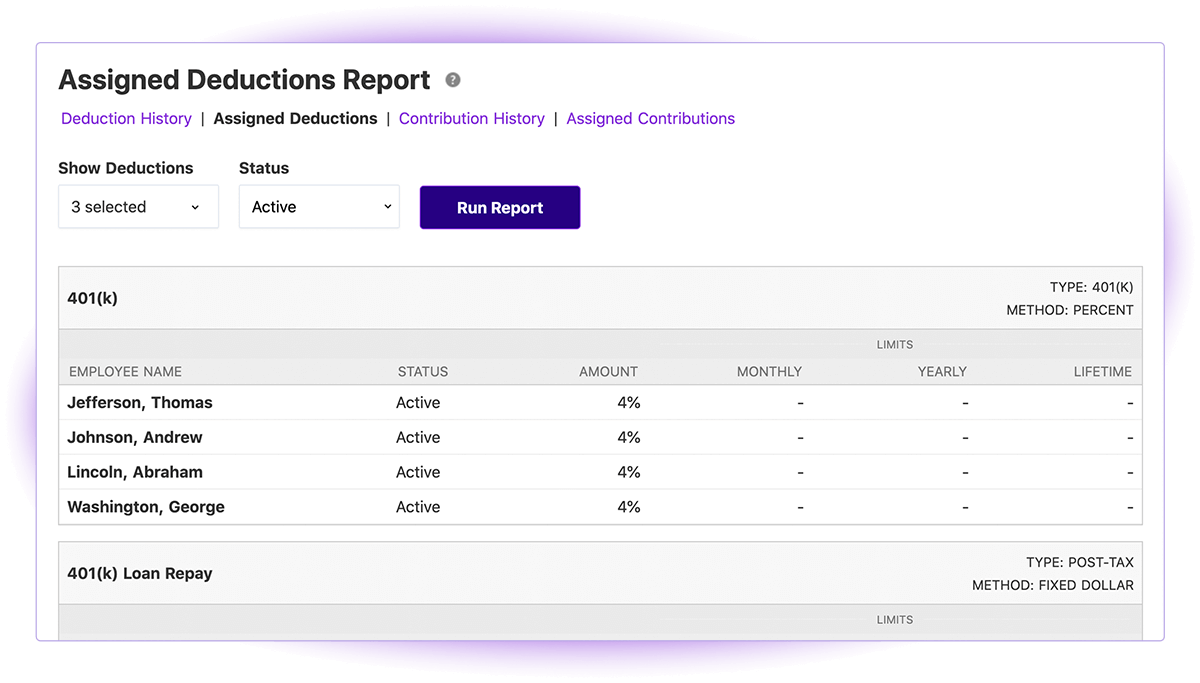

Payroll Software For Small Business Patriot Software

1

1

1390 Chautauqua St Batavia Il 60510 Mls 11376162 Zillow

Kentucky Usda Rural Housing Loans Kentucky Rural Development Guidelines For Usda Refinance Streamline Refinance Loans Mortgage Loans Mortgage Assistance

828 Evansburg Rd Collegeville Pa 19426 Mls Pamc2042798 Redfin

Tds Due Date List April 2020 Accounting Software Due Date Dating

Salary Payroll

Loan Payment Calculator Https Salecalc Com Loan Loan Payment Calculator